Getting Started

- Introduction

- Download

- Installation & Activation

- Troubleshooting

- Data Refresh/Updates

- Software Updates

- Manage Your Subscription

- Example Spreadsheets

General Formulas

Yahoo Finance

Technical Analysis Toolkit

- Introduction

- Simple Moving Average (SMA)

- Exponential Moving Average (EMA)

- Volume Weighted Average Price (VWAP)

- Average True Range (ATR)

- Moving Average Convergence/Divergence (MACD)

- Bollinger Bands

- Relative Strength Index (RSI)

- Aroon

Federal Reserve Economic Data

(FRED)

IG Index / IG Markets

- Account Setup

- Formula Reference

- VBA Functions Reference

- Historical Price Data Download To Excel

- Historical Price Data Download To File

- Historical Client Sentiment Data Download

- Watchlists

- Live Positions, Transactions & Activity History

EODHistoricalData.com

Nasdaq Data Link

Excel Formula Reference: Portfolio

Excel Price feed enables you to stream your Interactive Brokers portfolio data directly into your spreadsheet via a single, simple Excel formula.

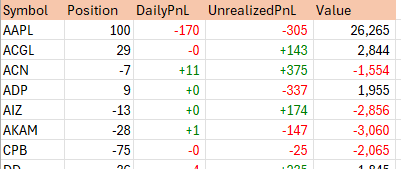

Here we can see our Interactive Brokers portfolio in Excel, updating in realtime:

This formula is a dynamic array formula and as such will return multiple rows and columns of data. Please see our dynamic array guide if you need more details on what Excel dynamic arrays are and how to use them.

You can either enter the formula manually in your spreadsheet or use the Configuration Pane to build the formula before inserting into your spreadsheet.

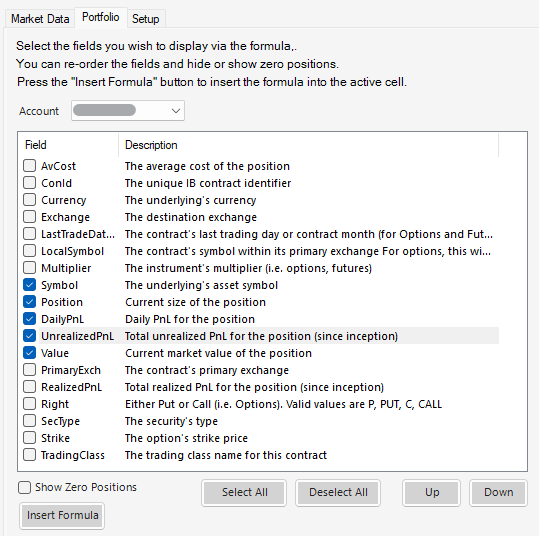

Enter formula using the Configuration Pane

Select the fields you want to return (you can change the order using the "Up" "Down" buttons).

Press the "Insert Formula" button to insert the formula into the currently active cell of your spreadsheet.

Enter the formula manually

=EPF.IB.Stream.Portfolio(fields, sortColumn, sortOrder, accountCode, showZeroPositions)

Input Parameters

| Parameter | Optional | Description |

|---|---|---|

| Fields | Yes | Comma separated list of fields to return, see "Portfolio Fields" section below for details. |

| SortColumn | Yes | Column name to sort on. |

| SortOrder | Yes | Sort order, either "ASC" for ascending or "DESC" for descending; default is ascending. |

| AccountCode | Yes | The Account Code of the portfolio. |

| ShowZeroPositions | Yes | Include zero positions, default is No. |

If you do not specify any parameters, i.e. just use the formula like this: =EPF.IB.Portfolio() then all fields will be returned for your default account.

Portfolio Fields

The first parameter defines which fields you want to return from the formula. If you don't specify any then all fields will be returned.

The order you list the fields corresponds to the order in which the fields are returned; for example if you want two columns: symbol first then value, specify "symbol,value".

| Field | Description |

|---|---|

| AvCost | The average cost of the position |

| ConId | The unique IB contract identifier |

| Currency | The underlying's currency |

| DailyPnL | Daily PnL for the position |

| Exchange | The destination exchange |

| LastTradeDateOrContractMonth | The contract's last trading day or contract month (for Options and Futures) |

| LocalSymbol | The contract's symbol within its primary exchange For options, this will be the OCC symbol. |

| Multiplier | The instrument's multiplier (i.e. options, futures) |

| Position | Current size of the position |

| PrimaryExch | The contract's primary exchange |

| RealizedPnL | Total realized PnL for the position (since inception) |

| Right | Either Put or Call (i.e. Options) |

| SecType | The security's type |

| Strike | The option's strike price |

| Symbol | The underlying's asset symbol |

| TradingClass | The trading class name for this contract |

| UnrealizedPnL | Total unrealized PnL for the position (since inception) |

| Value | Current market value of the position |

Examples

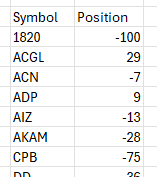

Stream my Interactive Brokers portfolio, showing only Symbol and Positon, for account "ABC1":

=EPF.IB.Portfolio("Symbol,Position", "ABC1")

Stream my Interactive Brokers portfolio, showing Symbol, Positon, DailyPnL, UnrealizedPnL and Value for my account:

=EPF.IB.Portfolio("Symbol,Position,DailyPnL,UnrealizedPnL,Value")