Getting Started

- Introduction

- Download

- Installation & Activation

- Troubleshooting

- Data Refresh/Updates

- Software Updates

- Manage Your Subscription

- Example Spreadsheets

General Formulas

Yahoo Finance

Technical Analysis Toolkit

- Introduction

- Simple Moving Average (SMA)

- Exponential Moving Average (EMA)

- Volume Weighted Average Price (VWAP)

- Average True Range (ATR)

- Moving Average Convergence/Divergence (MACD)

- Bollinger Bands

- Relative Strength Index (RSI)

- Aroon

Federal Reserve Economic Data

(FRED)

IG Index / IG Markets

- Account Setup

- Formula Reference

- VBA Functions Reference

- Historical Price Data Download To Excel

- Historical Price Data Download To File

- Historical Client Sentiment Data Download

- Watchlists

- Live Positions, Transactions & Activity History

EODHistoricalData.com

Nasdaq Data Link

Excel Formula Reference: Market Data

Excel Price Feed enables you to stream live market data directly into your Excel spreadsheet via a single, simple Excel formula.

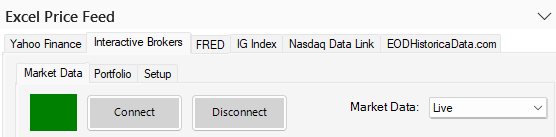

Before requesting any data, you may want to change the Market Data setting depending on what, if any, market data subscriptions you have with Interactive Brokers. You can do this via the Configuration Pane.

There are 4 possible options:

- Live: Streaming data relayed back in real time. Market data subscriptions are required.

- Delayed: Free, delayed data is 15 - 20 minutes delayed. This is available for many types of instruments without market data subscriptions. If live data is available a request for delayed data is ignored by Interactive Brokers.

- Frozen: Last data recorded at market close. Requires the same market data subscriptions necessary for live data.

- Delayed Frozen:Requests delayed "frozen" data for a user without market data subscriptions.

Generally you want to select "Live" if you have any market data subscriptions, otherwise "Delayed".

You can either enter the formula manually in your spreadsheet or use the Configuration Pane to build the formula before inserting into your spreadsheet.

Enter formula using the Configuration Pane

EPF.IB.Stream.MarketData

=EPF.IB.Stream.MarketData(field, symbol, securityType, currency, exchange, conId, primaryExchange, lastTradeDateOrContractMonth, strike, multiplier, right, tradingClass)

The input parameters are:

| Parameter | Optional | Description |

|---|---|---|

| Field | No | One of the available market data fields, see below for details. |

| Symbol | No | The symbol of the security. |

| Security Type | No | The security's type, see below for details. |

| Currency | No | The security's currency code, such as USD, EUR, JPY etc. |

| Exchange | No | The destination exchange, such as SMART, NYSE etc |

| Primary Exchange | Yes | The security's primary exchange. |

| Last Trade Date or Contract Month | Yes | The contract's last trading day or contract month (for Options and Futures). Strings with format YYYYMM will be interpreted as the Contract Month whereas YYYYMMDD will be interpreted as Last Trading Day. |

| Strike | Yes | Options only: the option's strike price. |

| Multiplier | Yes | The security's multiplier. |

| Right | Yes | Options only: "Put" or "Call" or "P" or "C" |

| Trading Class | Yes | The security's trading class name. |

Field

| Field | Description |

|---|---|

| BidPrice | Highest priced bid for the contract. |

| AskPrice | Lowest price offer on the contract. |

| LastPrice | Last price at which the contract traded (does not include some trades in RTVolume). |

| DelayedBid | Delayed bid price. |

| DelayedAsk | Delayed ask price. |

| DelayedLast | Delayed last traded price. |

| High | High price for the day. |

| Low | Low price for the day. |

| Volume | Trading volume for the day for the selected contract (US Stocks: multiplier 100). |

| ClosePrice | The last available closing price for the previous day. For US Equities, we use corporate action processing to get the closing price, so the close price is adjusted to reflect forward and reverse splits and cash and stock dividends. |

Security Type

| Security Type | Description |

|---|---|

| BOND | Bonds. |

| CASH | FX (Foreign Exchange) currency pairs. |

| CFD | CFDs (Contract For Difference). |

| CMDTY | Commodities. |

| CRYPTO | Cryptocurrencies. |

| FOP | Futures Options. |

| FUND | Mutual Funds. |

| FUT | Futures. |

| IND | Indexes. |

| OPT | Options. |

| STK | Stocks. |

| WAR | Standard Warrants. |

Examples

Stream the bid price of Apple stock:

Stream the ask price of spot gold: